C Market Coffee Crisis: Why Specialty Prices Aren't Immune

Why Your 'Specialty' Coffee Price Isn’t Immune to the C Market

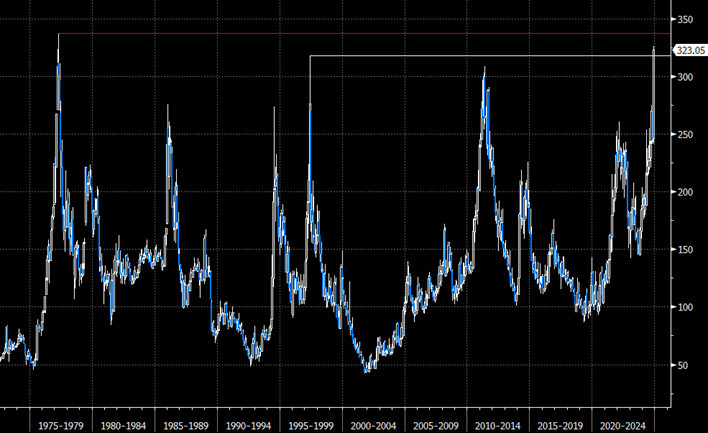

A line chart displaying the fluctuating price of coffee over time, showing a 47-year high in 2024

Specialty Coffee Price Shock: How the C Market Dictates Your $20 Pour-Over

Picture this: You’re sipping a $20 pour-over, feeling fancy because it’s "direct trade" and "ethically priced." Then—bam!—the price jumps next month. Wait, isn’t specialty coffee immune to market drama? Surprise! Even the fanciest beans dance to the beat of the commodity drum aka “The C Market”.

The C Market: The global commodity exchange (ICE Futures) where bulk coffee trades set baseline prices worldwide – even for specialty beans.

What is This "C Market”?

C = Commodity, which means Commodity coffees are the lowest tier available for purchase on the open market. It’s the invisible backbone of all coffee prices. Imagine a global auction where traders bet on coffee prices — like weather forecasters guessing rain. It’s where bulk coffee changes hands (think: 37,500-pound truckloads!). But here’s the kicker: even your small-batch roaster uses those prices as a starting line—the "minimum wage" of coffee.

Coffee Buyers Have New Standards

Another component affecting the C Market is the European Union imposing “deforestation rules.” Simply put, the EU is prohibiting placing products linked to deforestation (like cattle, cocoa, coffee, palm oil, soy, wood, rubber, and derivatives) on its market unless they are deforestation-free. On paper, if countries fail to meet this standard, it means a significant market goes dark for them.

Specialty Coffee’s Perfect Storm aka November 2024

Late 2024 was pure pandemonium. Brazil’s worst drought in 70 years collided with Vietnam’s climate whiplash (drought-to-monsoon whiplash). Then, the EU delayed its deforestation rules, throwing compliance into chaos. Traders panicked, and prices rocketed to $3.26/lb—a level unseen since disco ruled the charts.

How this plays out with your favorite shop: your roaster pays "C + $3" for that gorgeous Guatemalan. So when C leaped to $3.26/lb in November, that $5/lb coffee became $6.26/lb before roasting. Suddenly, your $20 bag costs $23.50. Ouch!

The Coffee Farmer’s Dilemma

While high prices should help farmers, many faced a lose-lose calculus:

Fertilizer costs soared 70% since 2022

Vietnamese growers lost crops to back-to-back droughts and typhoons

Some sold mediocre cherries as "commodity" at $3/lb rather than invest in specialty processing for minimal extra gain.

The November 2024 C Market spike’s impact on farmers, roasters, and cafés.

Why Ignoring the C Market Now Is Reckless

November’s volatility accelerated a silent crisis: small specialty traders vanishing. Giants like Sucafina swallowed Sustainable Harvest and Nordic Approach, narrowing roasters’ sourcing options. "When your niche importer gets acquired, your Ethiopian heirloom competes with a conglomerate’s commodity orders," notes a Seattle roaster.

This creates a power shift: farmers, traditionally price-takers, became price-makers. Many declined fixed contracts, selling to the highest bidder instead. Roasters who supported farmers through lean years now felt betrayed—exposing deep supply chain tensions.

In Closing: The Illusion of Immunity is Dead

November 2024 wasn’t an anomaly—it was climate change, geopolitics, and financialization colliding. Specialty coffee’s fate remains chained to the C Market, but its resilience lies in radical transparency and adaptive partnerships.

What This Transparency Looks Like:

Roasters: Track C prices like Wall Street traders. Build flexible contracts.

Drinkers: When prices jump, know it’s not greed—it’s 70% fertilizer hikes and $32M margin calls. Support brands explaining the "why."

☕ Until next brew,

Cognoscenti Coffee